India’s biggest tax reform since 2017 is here — and it’s going to impact your monthly budget, business costs, and even the way the economy grows. The GST Council has approved GST 2.0, a simplified two-slab structure with 5% and 18% tax rates (plus a 40% slab for luxury and sin goods), effective September 22, 2025.

So, what does this really mean for you and for millions of small businesses? Let’s break it down.

What’s Changing Under GST 2.0?

Until now, GST had four slabs — 5%, 12%, 18%, and 28%. This often created confusion, duty inversion (where inputs were taxed higher than finished goods), and a heavy compliance burden.

From September 22:

- 5% Slab → Essentials and daily-use items

- 18% Slab → Standard rate for most goods & services

- 40% Slab → Luxury & sin goods (yachts, personal-use aircraft, premium cars, tobacco, etc.)

This shift simplifies taxation and makes GST easier for both consumers and businesses.

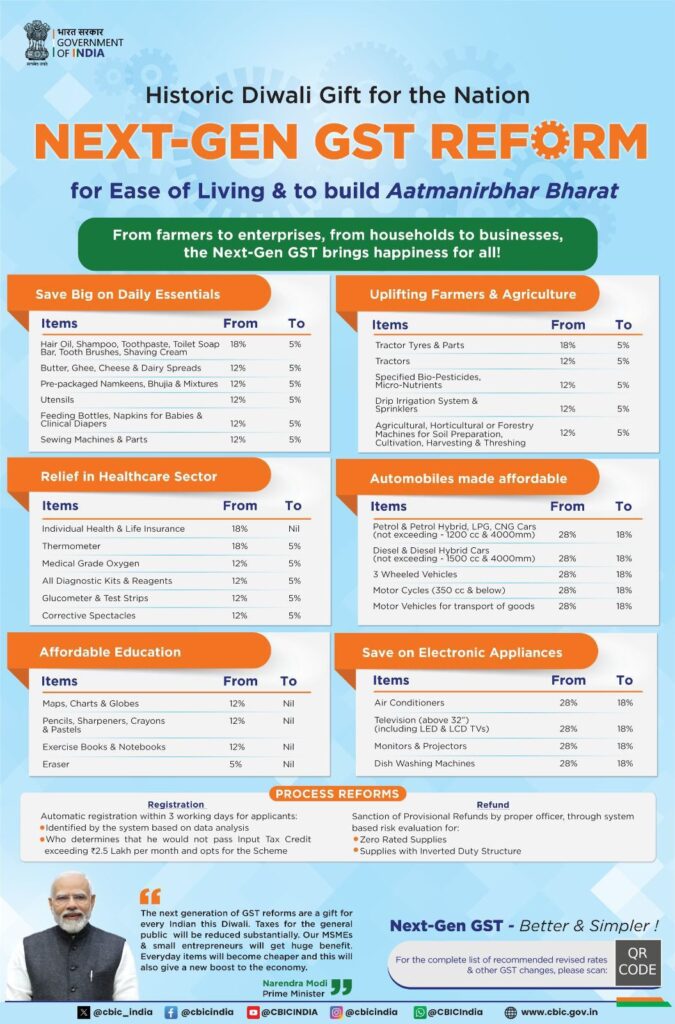

Cheaper Essentials for Consumers

Your grocery bill and household expenses are set to come down. Key reductions include:

- Food Items: Namkeen, bhujiya, sauces, pasta, instant noodles, chocolates, coffee, cornflakes, butter, ghee — all at just 5%.

- Electronics & Appliances: TVs (all sizes), ACs, dishwashers, small cars, motorcycles ≤350cc — moved to 18% from 28%.

- Healthcare Relief: GST on 33 life-saving medicines cut to 0%. Spectacles and vision-correcting lenses down from 28% → 5%.

In short, from your kitchen shelf to your living room electronics, many items will now cost less.

Relief in Health, Education & Insurance

One of the biggest wins for households is in insurance:

- All individual life insurance policies — term life, ULIP, endowment — are now GST-free.

- All health insurance policies, including family floater and senior citizen plans, are also exempt from GST.

This is a major step to make protection and healthcare affordable and increase insurance coverage across India. Families will save significantly on premiums.

Boost for Farmers & MSMEs

The GST 2.0 changes aren’t just about consumers — they also aim to empower MSMEs and farmers:

- Agriculture: Tractors, soil preparation machines, harvesting and threshing machines, composting equipment — all reduced to 5%.

- Renewable Energy & Green Growth: Solar panels, windmills, biogas plants, solar cookers, waste-to-energy devices — now at 5%.

- Labour-Intensive Sectors: Handicrafts, intermediate leather goods, bio-pesticides, and natural menthol — cut to 5%.

This means lower costs for small manufacturers and artisans, encouraging local production and exports. MSMEs, in particular, benefit from simplified slabs and reduced compliance headaches.

Policy Perspective: Why the Big Change?

The government’s key goals with GST 2.0 are:

- Simplification: Two main slabs make it easier for businesses and consumers to understand.

- Correcting Duty Inversion: Especially in textiles, where raw materials were taxed higher than final products.

- Compliance Relief for MSMEs: Better refund systems and reduced complexity lower the burden on small businesses.

- Economic Boost: Lower taxes on essentials will increase consumption, while affordable insurance and medicines improve social security.

It’s not just a rate cut — it’s a structural reform to make India’s indirect tax regime next-gen and growth-oriented.

What Gets Costlier?

While most essentials are cheaper, some categories are moving up:

- Ready-made garments above ₹2,500 → now taxed at 18% (from 12%).

- Luxury vehicles, yachts, private jets, and motorcycles above 350cc → pushed to the 40% slab.

- Premium lifestyle goods like expensive watches, high-end apparel, and sin goods (tobacco, alcohol) remain heavily taxed.

This helps balance revenue loss from essential cuts while targeting high-end consumption.

Final Takeaway

For households, GST 2.0 means lower costs on food, medicines, appliances, insurance, and more. For MSMEs, it brings simpler slabs, cheaper inputs, and less compliance stress. And for India’s economy, it sets the stage for higher consumption, greater insurance penetration, and stronger MSME growth.

cheaper essentials + empowered small businesses + simplified compliance = stronger India.